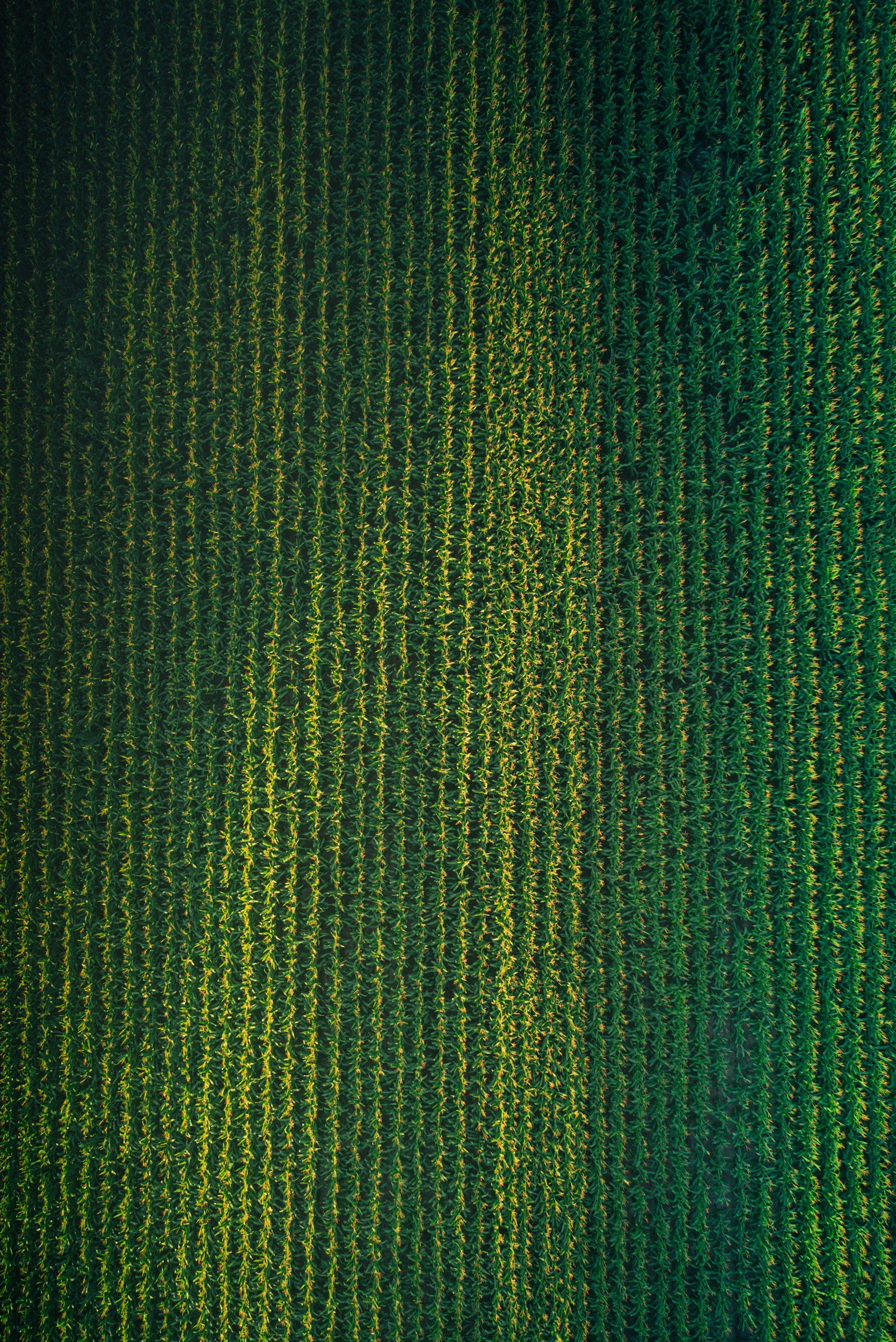

We invest in farmers who are invested in soil health.

Proudly

SoilBank starts where traditional farm lending stops.

How it works.

Invest: SoilBank makes an equity investment in exchange for a minority share in your land, which can help you reduce your down payment and / or loan size

Service: Annually after harvest, pay SoilBank a flexible premium proportional to their share in the land

Decide: You can buy out SoilBank’s share at fair market value anytime after Year 8, or maintain SoilBank as a partner in perpetuity

SoilBank earns through appreciation in farmland and annual crop premiums - no hidden fees or surprises.

Frequently Asked Questions (FAQs)

-

SoilBank is not a non-profit venture: SoilBank earns through appreciation in farmland and annual crop premiums - no hidden fees or surprises.

-

SoilBank wins when you win - SoilBank is betting on the fact that farmland with the best stewards will be worth more in the long run.

-

SoilBank has raised money from institutional and impact investors interested in supporting Canadian regenerative farmers while getting exposure in their investment portfolio to regenerative farmland.

-

No. SoilBank owns a minority non-controlling share. Control and title of the land is in your name.

-

If the land is sold with the estate, so is SoilBank’s share. If the land is passed to the next generation, the SoilBank contract will continue - including all the same options to buy out SoilBank.

-

Our relationship is a partnership. You can buy out SoilBank’s share at fair market value anytime after Year 8, or maintain SoilBank as a partner in perpetuity.

-

No. SoilBank is a partner on farmland only, not your operation. You are the steward of your farm, including our share.